On May 19, 2021, the U.S. Food and Drug Administration (FDA) released an updated guidance in draft form on how to complete the Statement of Investigator form (Form FDA 1572). The guidance addresses frequently asked questions from sponsors, clinical investigators, and institutional review boards (IRBs), and it provides new information on waivers of the Form FDA 1572 signature requirement, which is particularly relevant for sponsors of clinical trials that include sites located outside the U.S.

On May 19, 2021, the U.S. Food and Drug Administration (FDA) released an updated guidance in draft form on how to complete the Statement of Investigator form (Form FDA 1572). The guidance addresses frequently asked questions from sponsors, clinical investigators, and institutional review boards (IRBs), and it provides new information on waivers of the Form FDA 1572 signature requirement, which is particularly relevant for sponsors of clinical trials that include sites located outside the U.S.

Form 1572 is an agreement signed by an investigator to provide certain information to the sponsor and comply with FDA regulations on conducting a clinical investigation of an investigational drug or biologic, and under 21 CFR Part 312, an investigator must sign this agreement before participating in a trial. FDA’s previous guidance on the Form 1572 requirements and process, issued in 2010, touches briefly on the responsibilities of investigators conducting foreign studies under an investigational new drug application (IND) in the U.S., but it does not go into detail on how sponsors should proceed when an ex-U.S. investigator cannot or will not sign the 1572 (e.g., because the commitments for investigators on the Form 1572 extend beyond or conflict with what local law requires).

Under the updated guidance, FDA provides detailed steps for sponsors to request a waiver of the Form 1572 signature requirement for foreign investigators. A Form 1572 waiver allows a trial at a foreign site to take place under an IND even when the investigator cannot or will not sign the Form 1572, as noted above. When requesting a waiver, the sponsor should propose an alternative course of action to adequately satisfy the purpose of a signed Form 1572, and the sponsor must request and receive a 1572 waiver for an investigator before the study is initiated at the investigator’s site. Importantly, the guidance provides examples of sponsor and investigator commitment statements that would satisfy FDA’s guidelines for granting a waiver, and FDA recommends using these templates to enable FDA’s efficient review of a waiver request.

Overall, the guidance provides greater clarity on when a Form 1572 waiver would be needed and how a sponsor can obtain one. Sponsors planning to conduct a clinical study at a foreign site under an IND should review the updated guidance and, if a waiver is needed, factor in time for submission and FDA review of a waiver request before initiating the trial at a foreign site. Additionally, sponsors should ensure that clinical trial agreements with foreign sites contemplate Form 1572 completion and signatures and/or waivers when necessary.

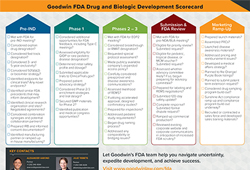

Developing a new drug or biologic is a complex process. Based on our extensive experience advising early-stage and clinical-stage companies, the Goodwin FDA team created this “scorecard” for companies to use as a guide as they navigate the FDA drug development and approval process. The drug development scorecard (or checklist) can help companies keep track of progress, identify opportunities, and achieve milestones that are appropriate for each stage of development.

Developing a new drug or biologic is a complex process. Based on our extensive experience advising early-stage and clinical-stage companies, the Goodwin FDA team created this “scorecard” for companies to use as a guide as they navigate the FDA drug development and approval process. The drug development scorecard (or checklist) can help companies keep track of progress, identify opportunities, and achieve milestones that are appropriate for each stage of development. On May 19, 2021, the U.S. Food and Drug Administration (FDA) released an

On May 19, 2021, the U.S. Food and Drug Administration (FDA) released an  Companies often use equity incentives to reward key members of their workforce and attract and retain the best talent. In the UK, companies have typically granted EMI options (a government‑backed, tax-advantageous share option) or unapproved options. However, where a company is unable to grant EMI options (for example, because the company is not sufficiently ‘independent’, the company’s gross assets exceed the relevant threshold when the option is to be granted or the individual is not an employee of the company) and it does not want to grant an unapproved option, then growth share schemes can be used as an alternative.

Companies often use equity incentives to reward key members of their workforce and attract and retain the best talent. In the UK, companies have typically granted EMI options (a government‑backed, tax-advantageous share option) or unapproved options. However, where a company is unable to grant EMI options (for example, because the company is not sufficiently ‘independent’, the company’s gross assets exceed the relevant threshold when the option is to be granted or the individual is not an employee of the company) and it does not want to grant an unapproved option, then growth share schemes can be used as an alternative.